Apollo Financial Models

Accretion-Dilution Financial Model Excel Spreadsheet Template

Accretion-Dilution Financial Model Excel Spreadsheet Template

Couldn't load pickup availability

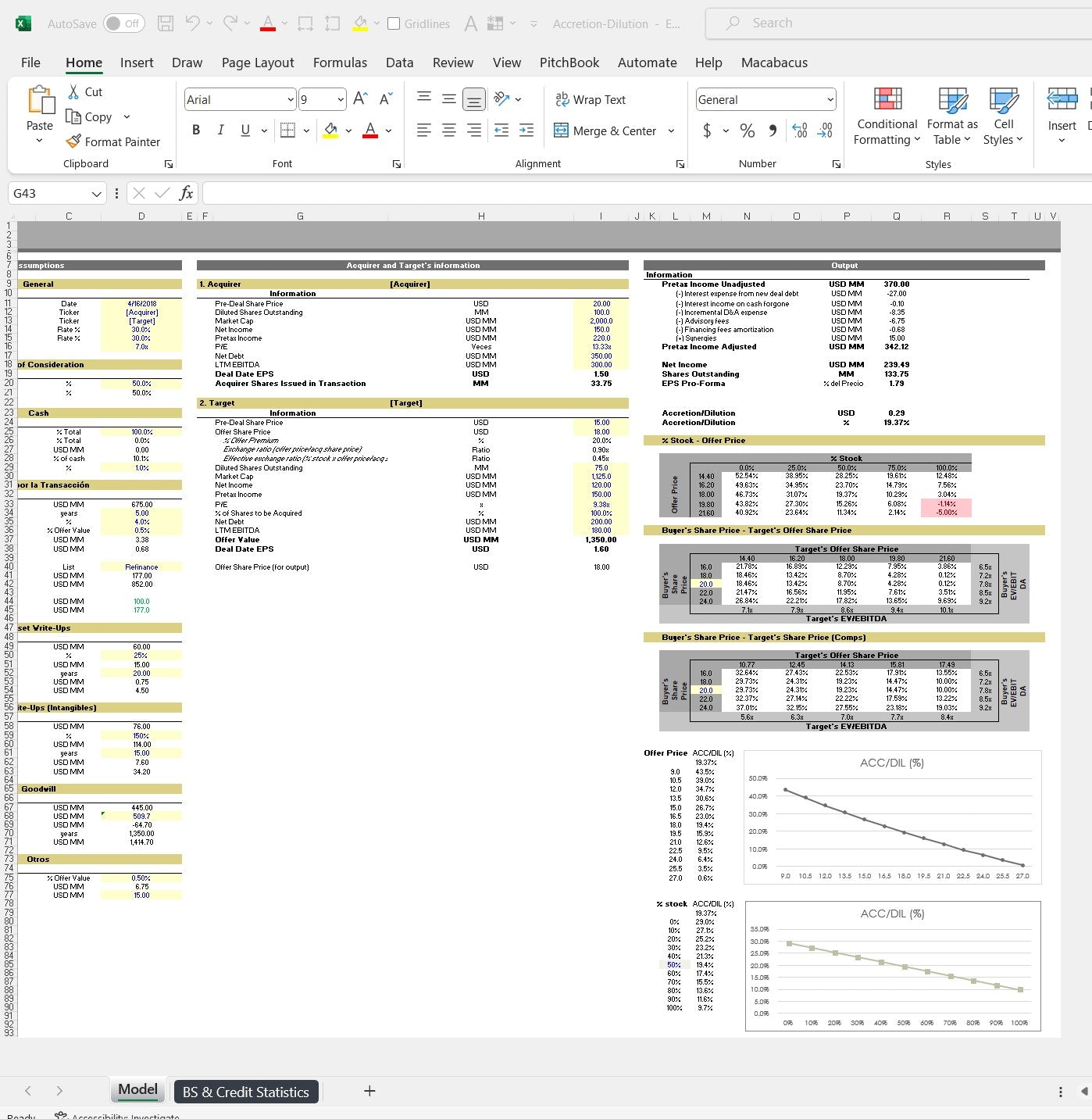

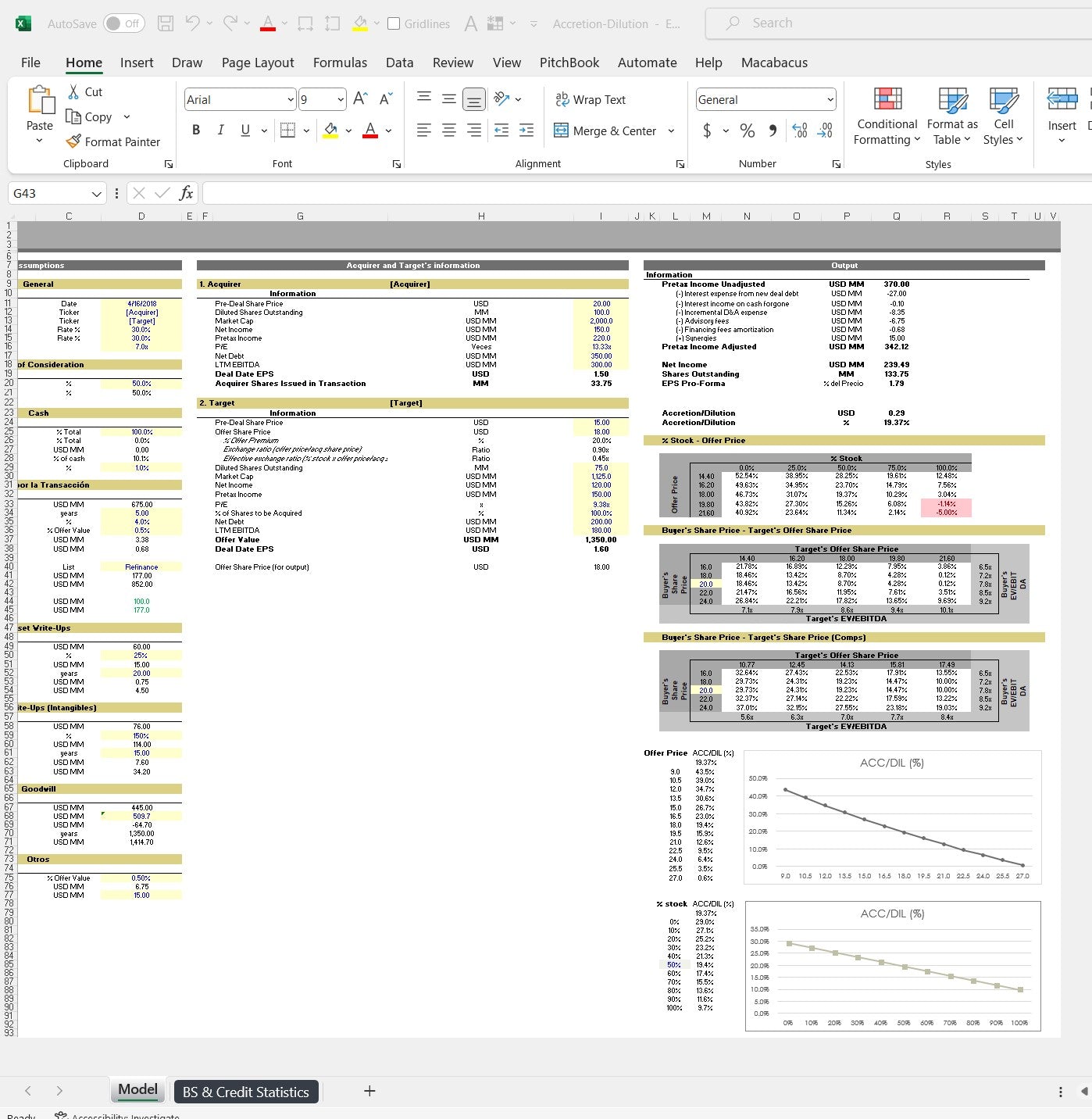

The Accretion-Dilution Financial Model is a powerful tool designed to assist organizations in evaluating the financial impact of potential mergers and acquisitions (M&A) transactions. This model is particularly valuable in strategic decision-making by assessing whether a proposed deal will result in accretion (increased earnings per share or EPS) or dilution (reduced EPS) for the acquiring company.

Key Features:

1. Detailed Assumptions: The model starts with a comprehensive input section where you can define the assumptions for the target company’s financials, the purchase price, financing terms, and integration costs. These assumptions form the foundation of the analysis.

2. Sensitivity Analysis: The heart of this model lies in its ability to perform sensitivity analysis. By varying key parameters, such as revenue growth, cost synergies, or financing terms, you can evaluate multiple scenarios to understand how changes impact the accretion or dilution effect. This provides critical insights into the deal’s sensitivity to various factors.

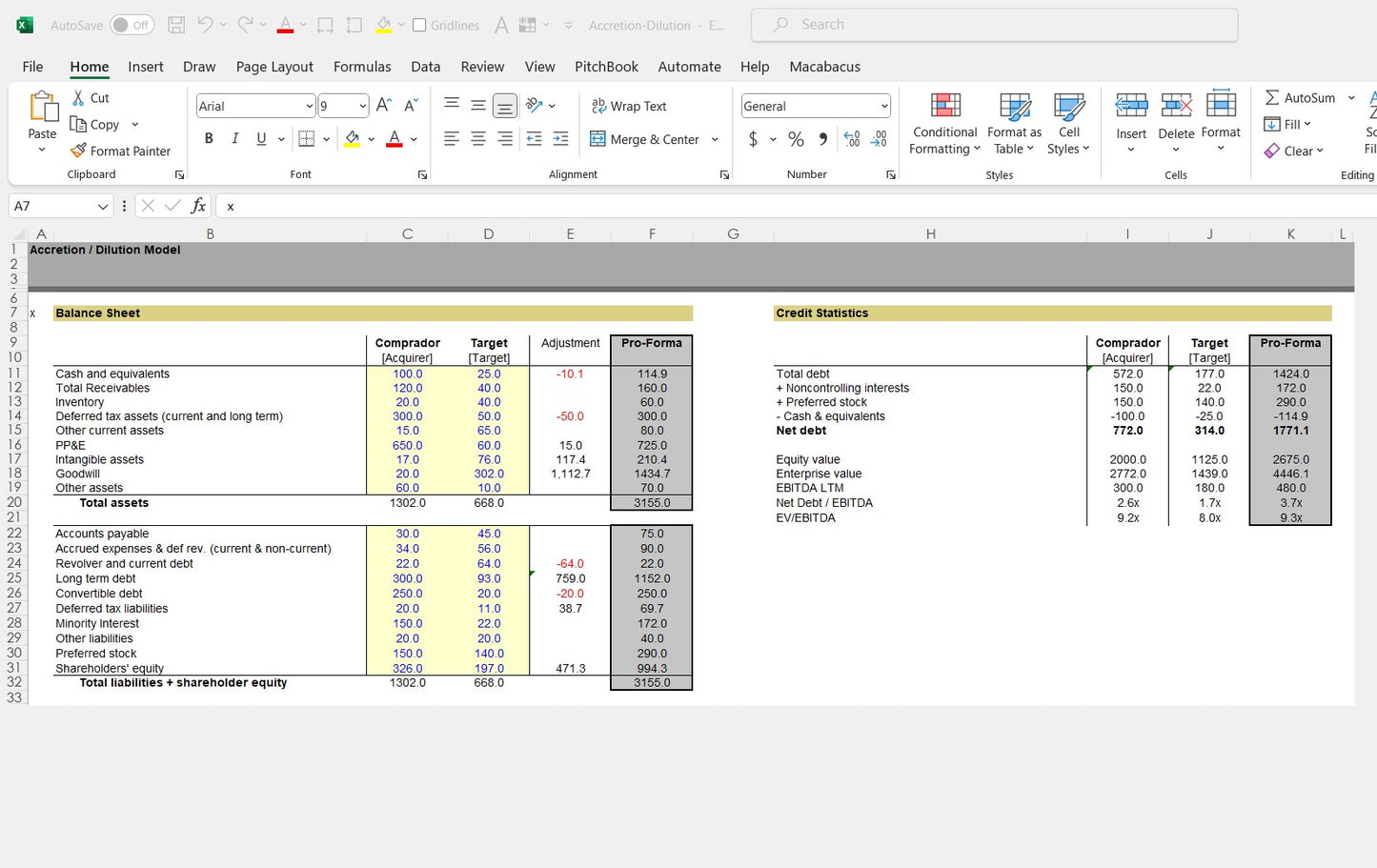

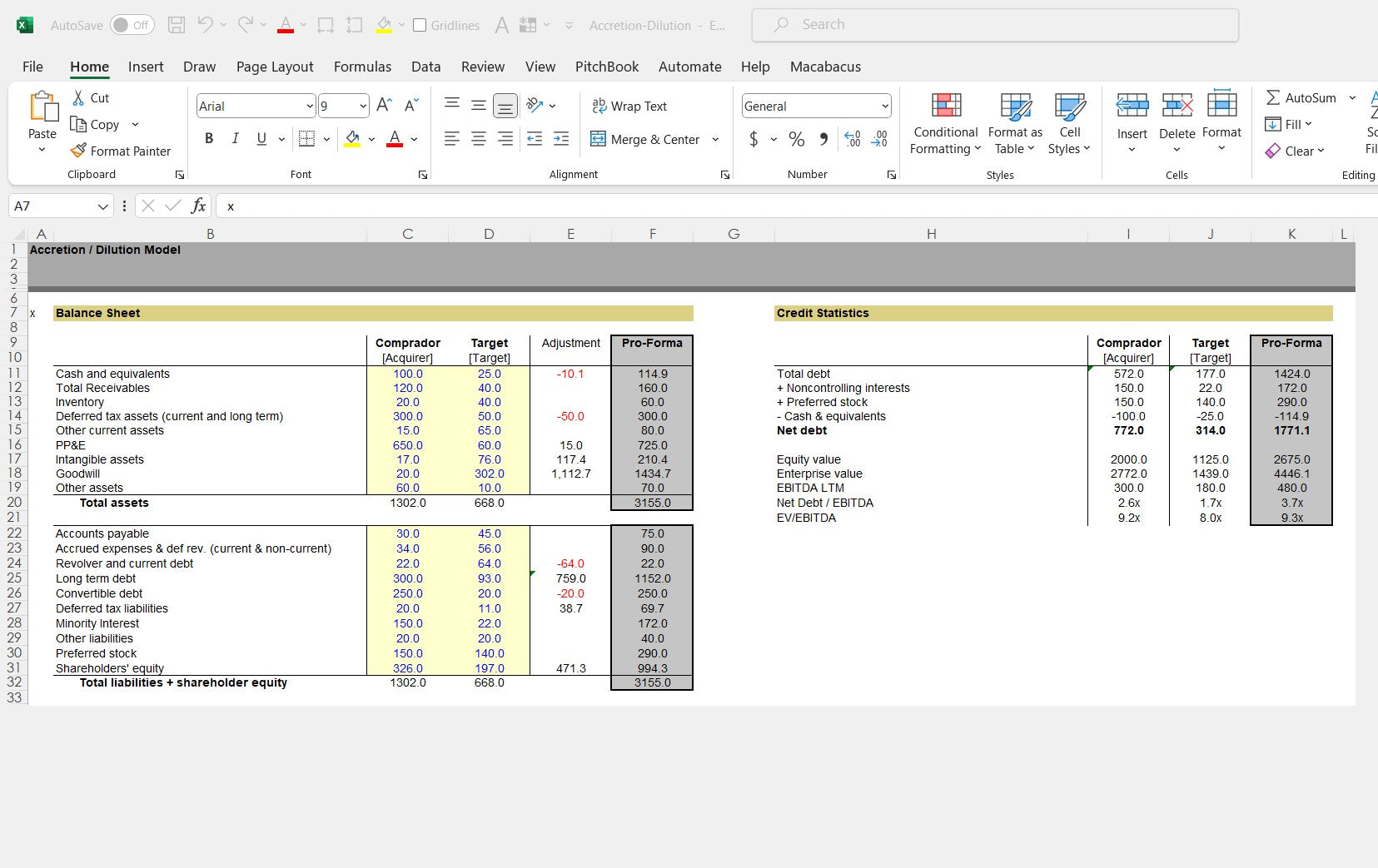

3. Pro Forma Analysis: The pro forma analysis section calculates the combined financials of the acquiring and target companies post-acquisition. This includes pro forma revenue, expenses, and EPS. It allows you to visualize the financial impact of the merger and determine whether it aligns with your strategic goals.

4. Accretion-Dilution Analysis: The model calculates the accretion or dilution in EPS resulting from the M&A transaction. This is a pivotal metric in assessing the value-creation potential of the deal. Positive accretion indicates the deal may enhance shareholder value, while dilution suggests a potential decrease in value.

5. Scenario Planning: This model enables you to create various scenarios, considering different assumptions and potential outcomes. By doing so, you can make informed decisions based on a range of possibilities, reducing risks associated with M&A.

Decision-Making Tool:

The Accretion-Dilution Financial Model serves as a decision-making compass for M&A activities. It empowers executives, finance professionals, and dealmakers to quantify and visualize the financial implications of proposed acquisitions, aiding in strategic alignment and risk mitigation.

Conclusion:

In summary, the Accretion-Dilution Financial Model combines detailed assumptions, sensitivity analysis, and pro forma analysis to provide a comprehensive view of the financial impact of M&A transactions. This versatile tool is essential for organizations seeking to make informed decisions about potential acquisitions and their impact on earnings and shareholder value.

Product Usage Policy: Apollo Financial Models disclaims any warranties, expressed or implied, regarding the reliability, accuracy, or performance of our products/services. We cannot guarantee that they will be error-free Visit our Site Policy page for further information

Instant Download:

Your Excel file will be available to download once payment is confirmed.

The download link will be ready on the page after the checkout procedure.

You will also receive the download link to your email.

Digital items don’t accept returns, exchanges, or cancellations.

This is a digital item. No product will be shipped physically.

Site Policies:

Thank you for choosing Apollo Financial Models. We take pride in providing quality products/services to our valued customers. As we strive for transparency, it's essential to mention that we operate under a No Refund, No Return Policy. Please visit our Site Policies page for a detailed explanation of all our usage policies.