Apollo Financial Models

Initial Public Offering (IPO) Financial Model Excel Spreadsheet Template

Initial Public Offering (IPO) Financial Model Excel Spreadsheet Template

Couldn't load pickup availability

Welcome to the IPO Excel Spreadsheet Model, the ultimate tool for companies across various industries preparing for a successful Initial Public Offering (IPO). Whether you’re in technology, healthcare, finance, or any other sector, this comprehensive and versatile model provides the insights and calculations you need for a successful IPO process.

Why Choose Our Model?

Comprehensive IPO Preparation:

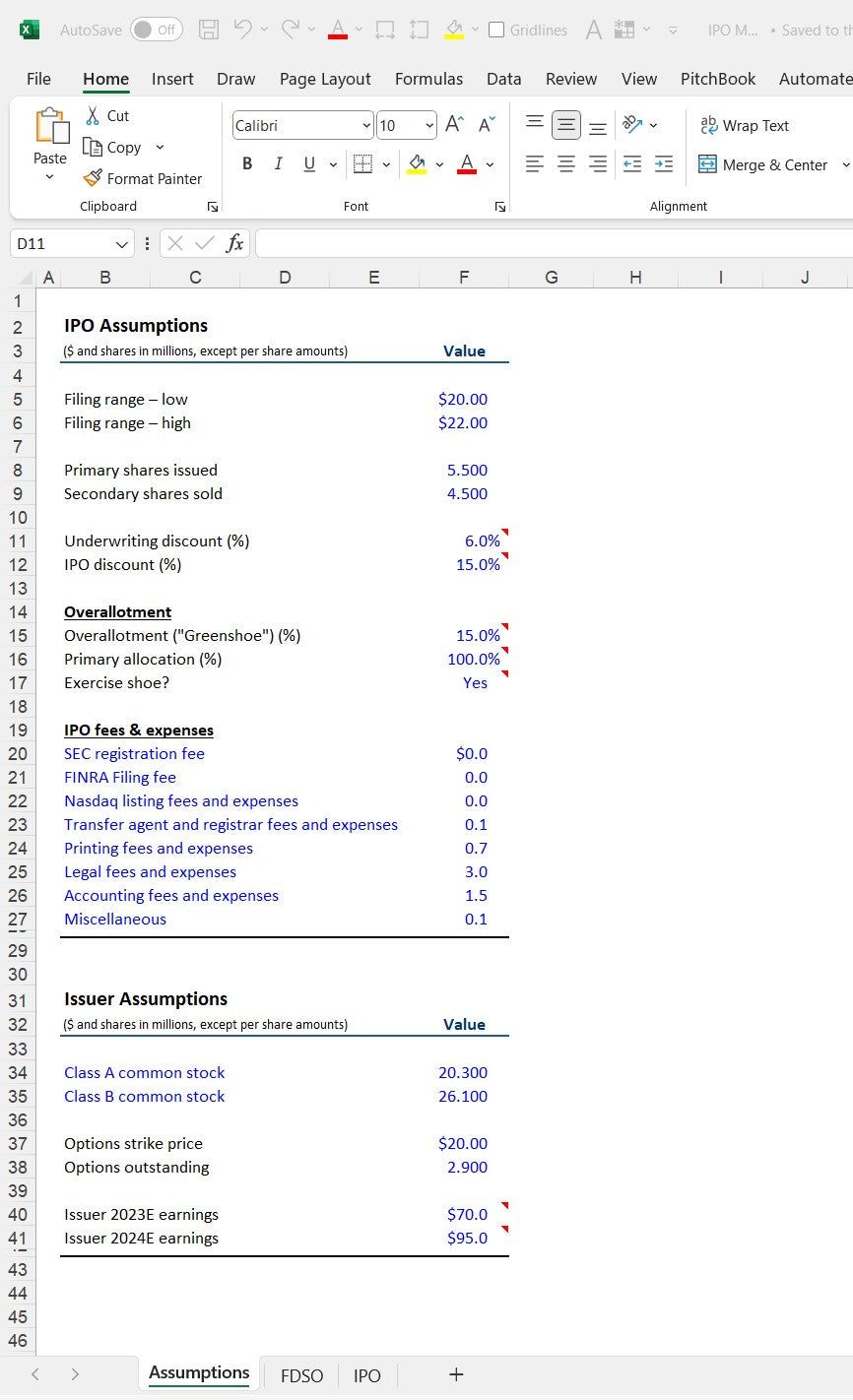

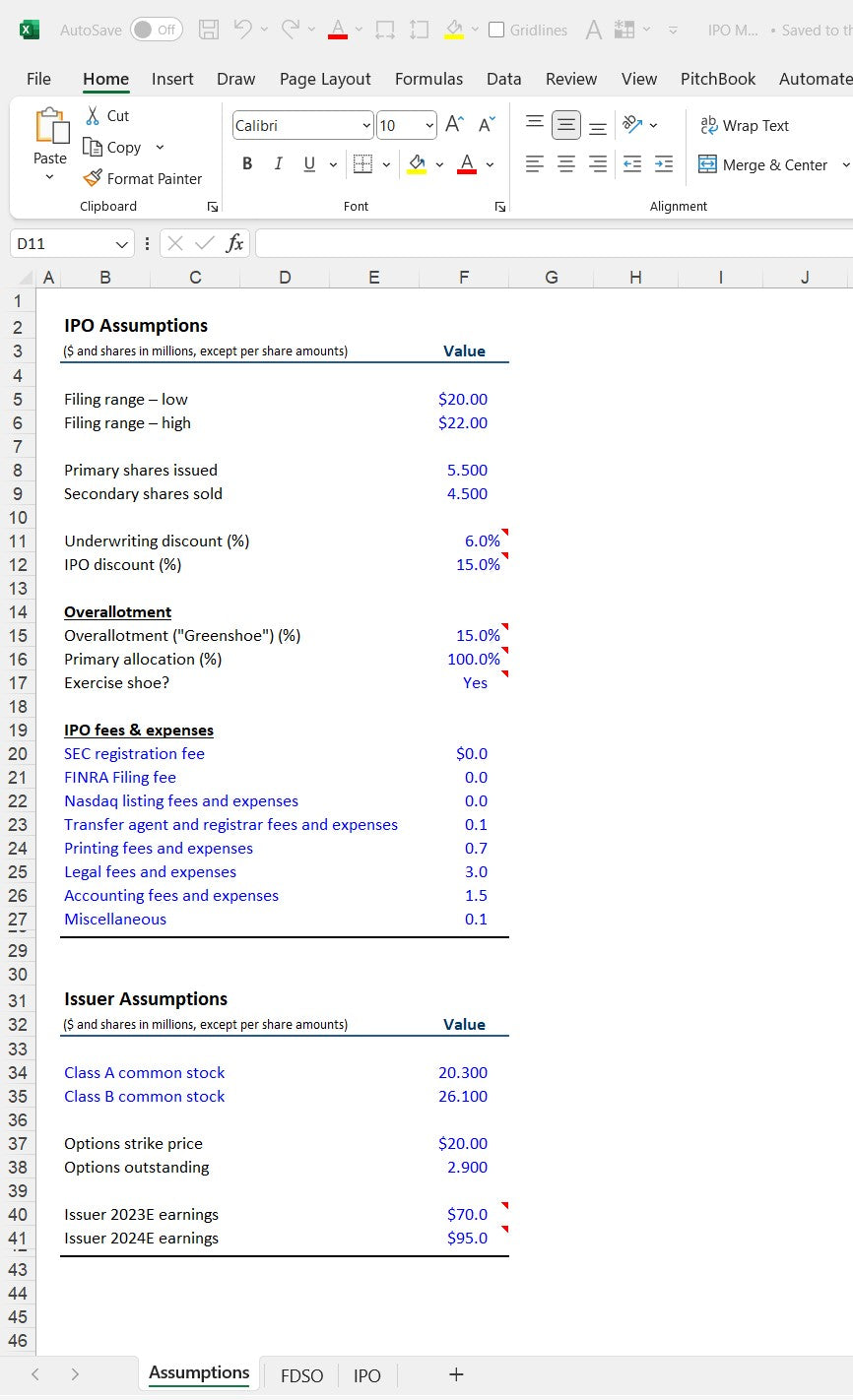

1. Detailed Assumptions Tab:

- Filing Range: Define your desired IPO price range to gauge potential market demand and set expectations.

- Shares Issued: Determine the number of primary and secondary shares to be issued, optimizing your capital structure.

- Overallotment: Plan for potential oversubscription with an overallotment option, ensuring flexibility in your IPO strategy.

- IPO Fees and Expenses: Estimate the costs of going public, including underwriting fees, legal expenses, and other related costs.

- Issuer Assumptions: Customize assumptions such as projected revenue growth, cost structures, and market conditions specific to your industry.

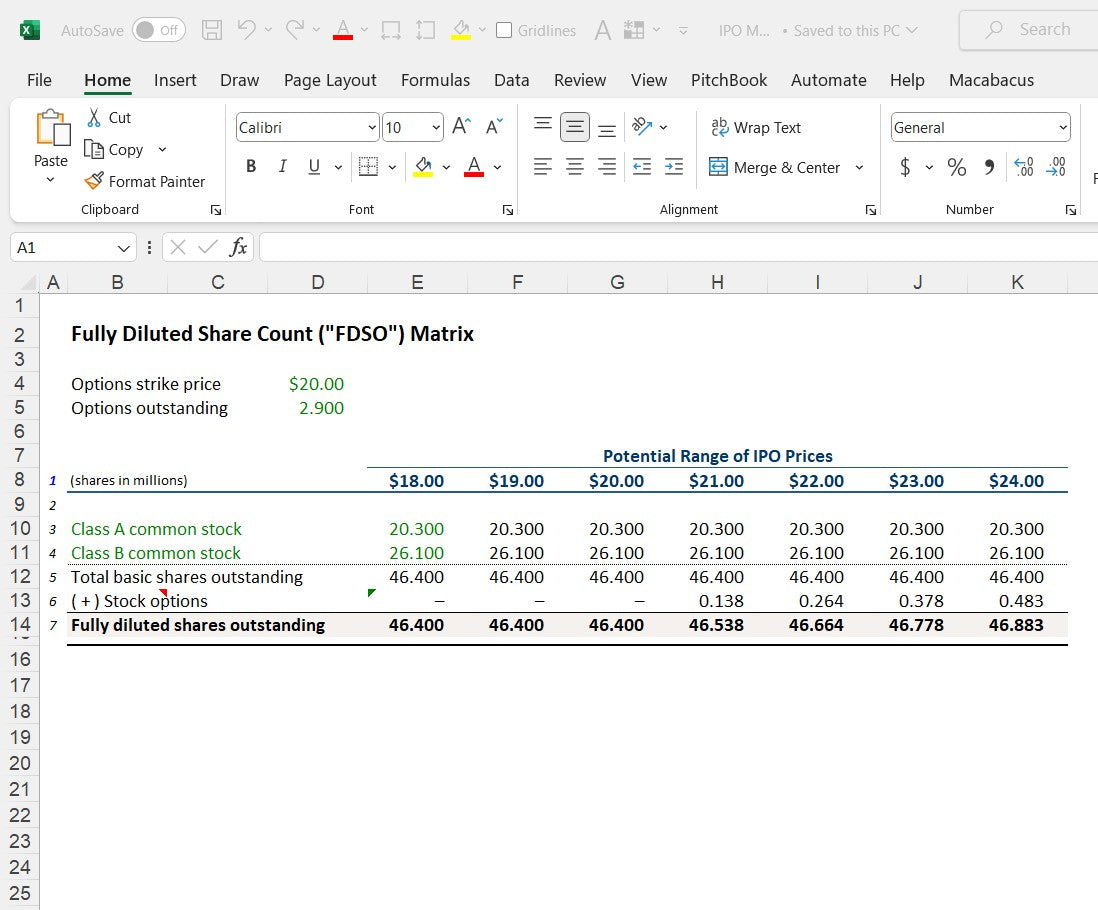

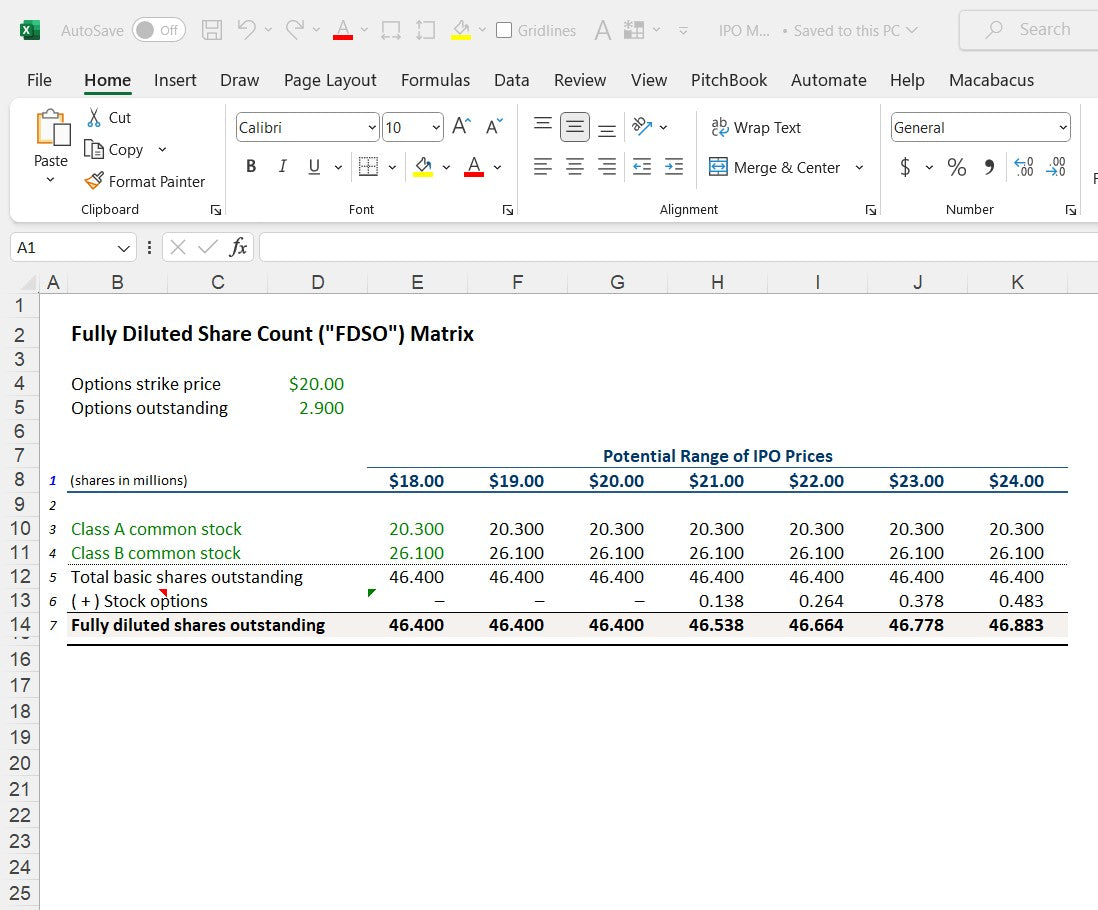

2. Fully Diluted Shares Count Analysis Tab:

- Comprehensive Dilution Analysis: Examine various scenarios including employee stock options, convertible securities, and other potential dilution factors for a realistic post-IPO ownership distribution.

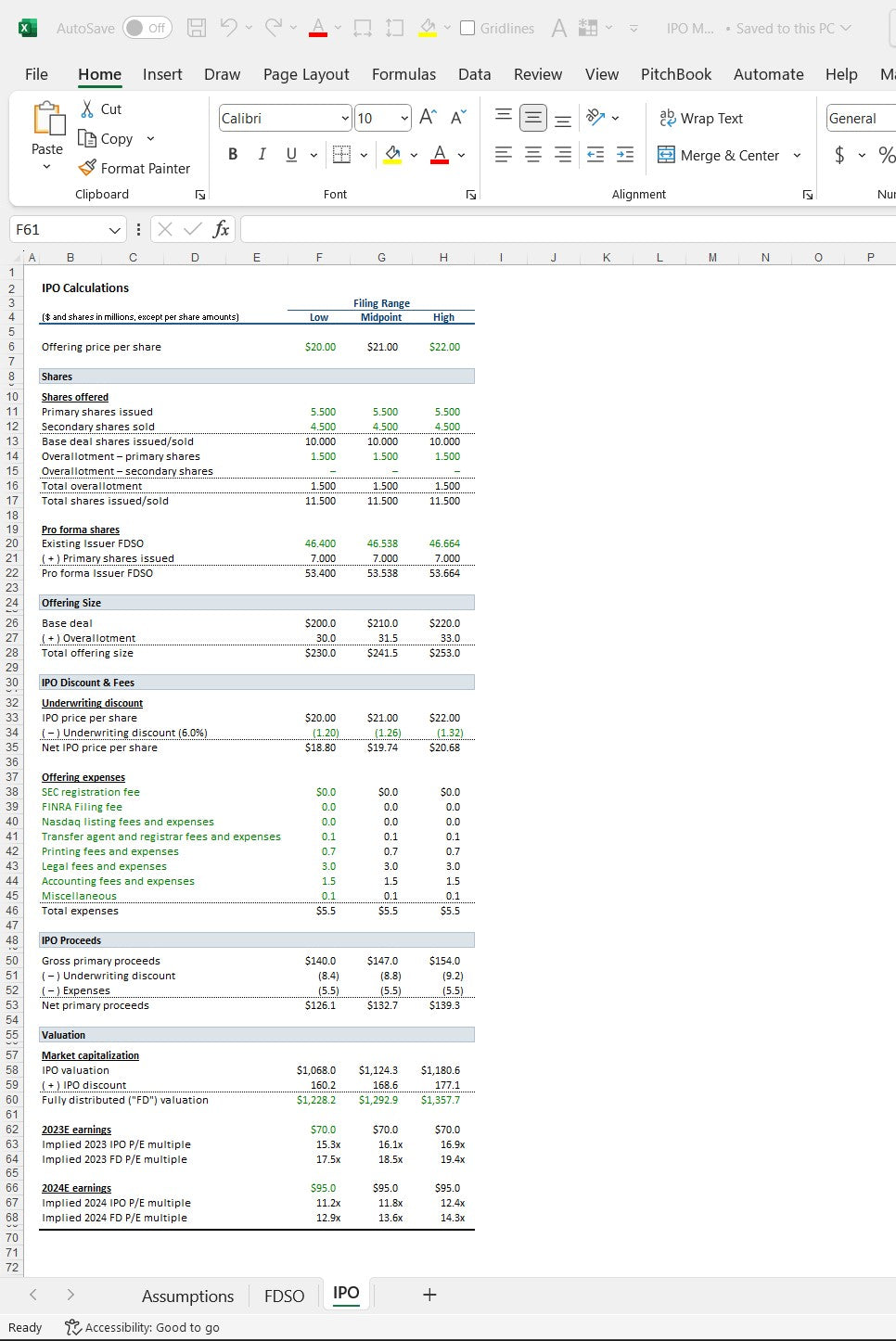

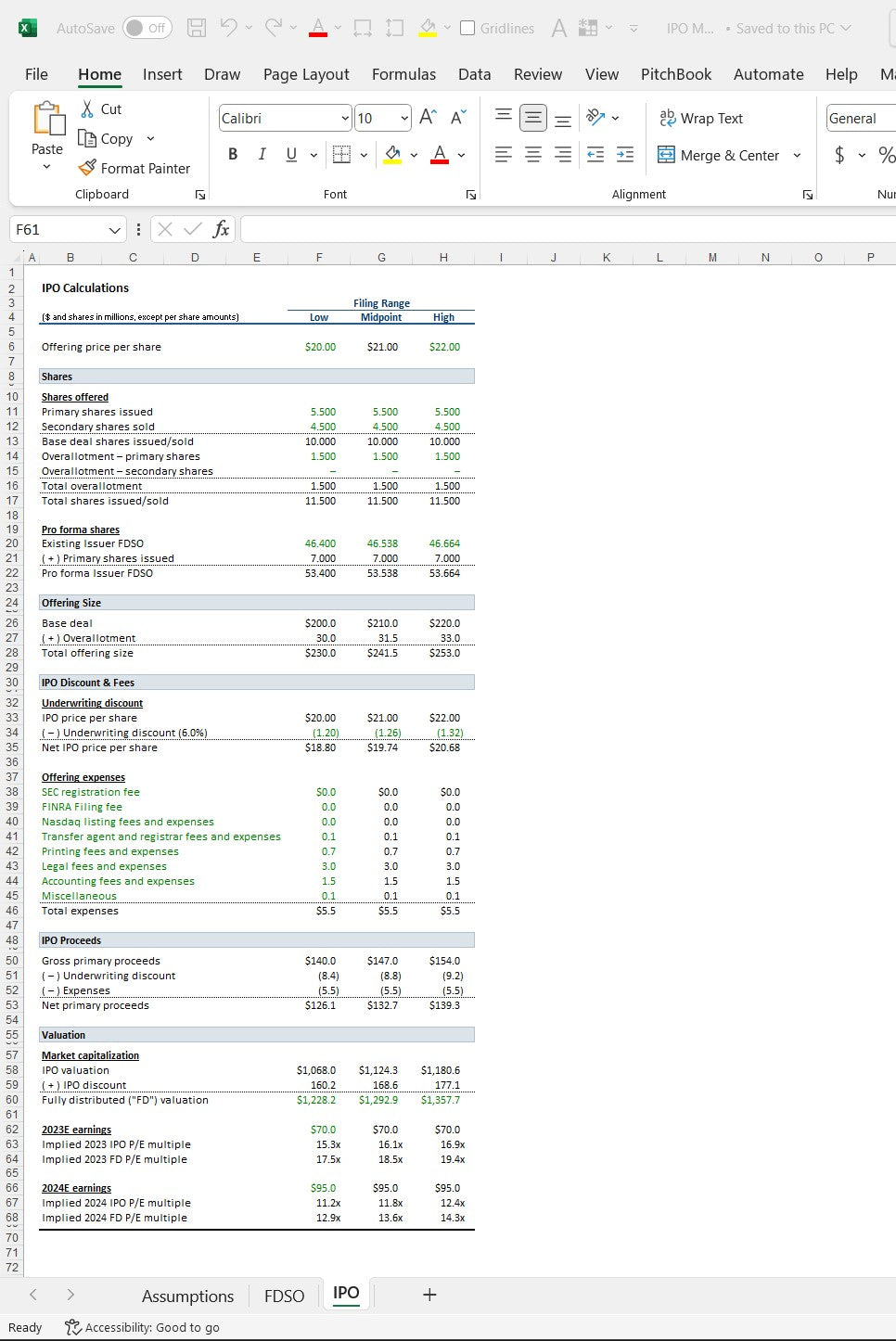

3. IPO Tab – Model Outputs:

- Sensitivity Analysis: Explore different IPO prices to see how they impact the success of your offering and identify the optimal price point.

- Pro-forma Shares Analysis: Understand the post-IPO capital structure and ownership breakdown among shareholders.

- Offering Size: Determine the size of your offering based on your capital-raising goals and desired share price.

- IPO Discount and Fees: Calculate the IPO discount, underwriting fees, legal fees, and other associated costs.

- IPO Proceeds: Project the capital your company will raise through the IPO.

- Valuation Outputs: Evaluate post-IPO market capitalization and enterprise value to understand your company’s perceived worth.

Versatile Across Industries:

- Adaptable for Any Sector: This model’s flexibility makes it suitable for companies in various industries looking to go public. Tailor the assumptions and inputs to fit the unique characteristics of your business.

Benefits:

Strategic IPO Planning:

Prepare for your IPO with detailed financial projections, sensitivity analyses, and comprehensive valuation calculations.

Informed Decision-Making:

Make strategic decisions with insights into IPO pricing, share issuance, and overall capital structure.

Attract Investors:

Present detailed and investor-friendly analyses to enhance your IPO’s appeal to potential investors.

Mitigate Risks:

Identify and address potential risks with thorough sensitivity analysis and scenario planning.

Tailored to Your Needs:

Customize the model for your specific industry and business goals to achieve the best IPO outcomes.

Transparent and Reliable:

Showcase clear assumptions and methodologies to ensure transparency and reliability throughout the IPO process.

Take the Next Step Towards a Successful IPO!

Unlock detailed financial projections, dynamic scenario analyses, and expert valuation techniques with our Generic IPO Excel Spreadsheet Model. Download now to start your IPO journey with confidence and precision!

Instant Download:

- Immediate Access: Your Excel file will be available for download as soon as payment is confirmed.

- Easy and Secure Download: The link will be provided on the checkout page and sent to your email.

Note:

- This is a digital product. No physical item will be shipped.

- Digital items are non-returnable and non-refundable.

Site Policies:

At Apollo Financial Models, we are dedicated to providing high-quality products and services. For transparency, we operate under a No Refund, No Return Policy. Please visit our Site Policies page for detailed information on our usage policies.