Apollo Financial Models

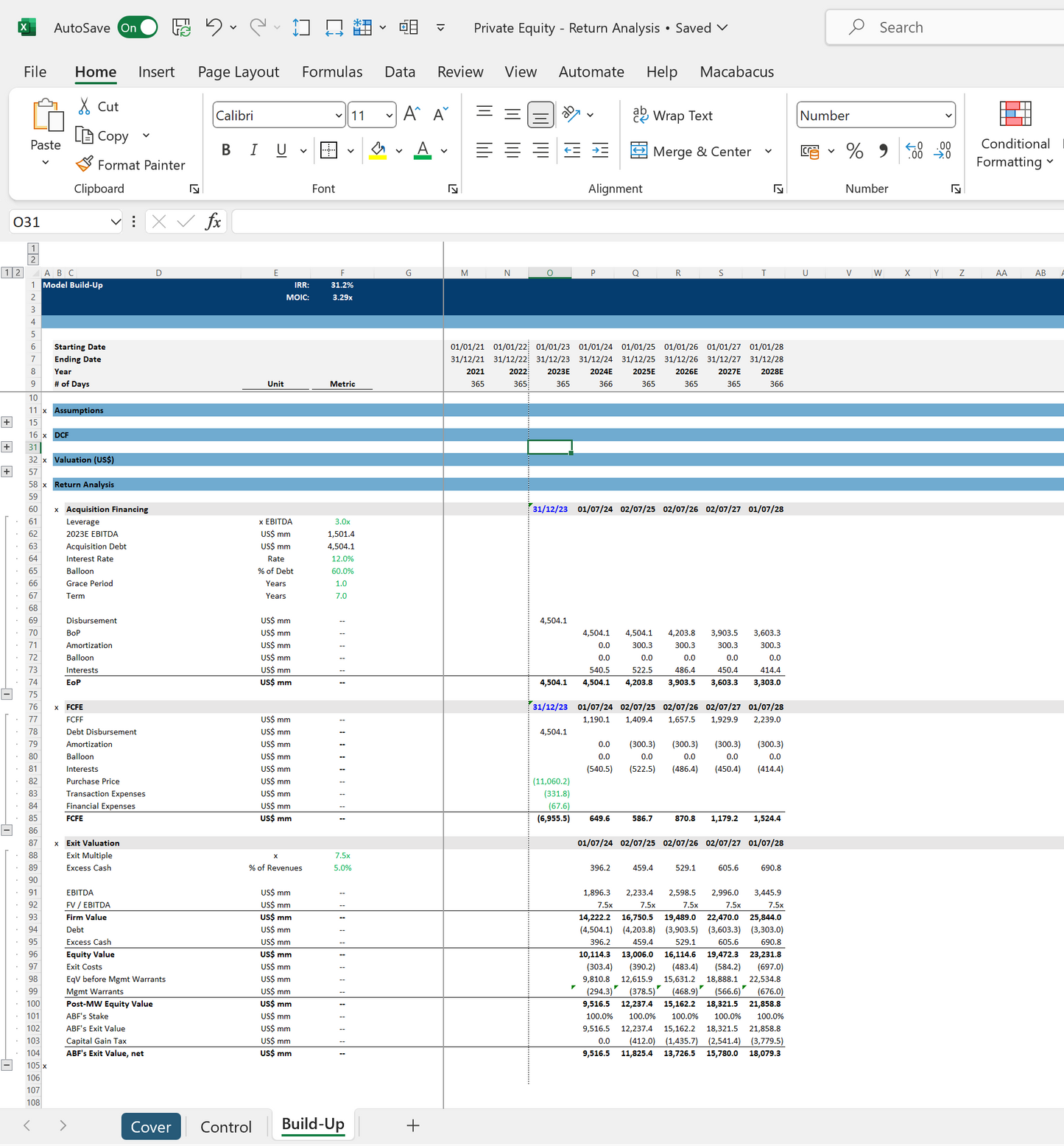

Leverage Buyout (LBO) and Return Analysis - Private Equity Model Excel Spreadsheet Template

Leverage Buyout (LBO) and Return Analysis - Private Equity Model Excel Spreadsheet Template

Couldn't load pickup availability

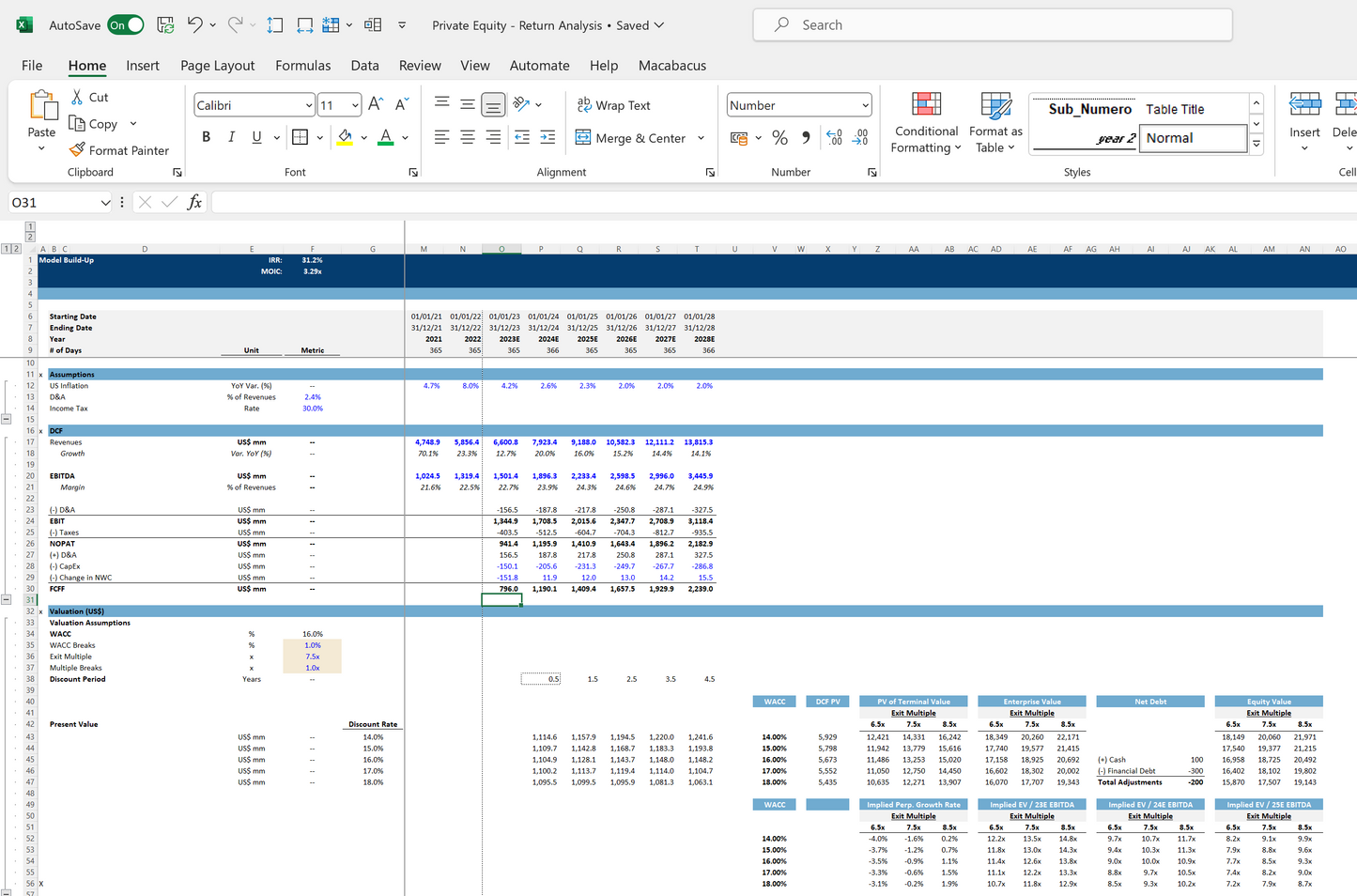

Our Private Equity Financial Model is a comprehensive and versatile tool designed for investment professionals seeking in-depth analysis and strategic insights for evaluating potential investments. Whether you’re a seasoned private equity investor or a newcomer to the field, this model provides a structured approach to assess the financial viability and potential returns of investment opportunities.

Key Components and Features

1. Assumptions:

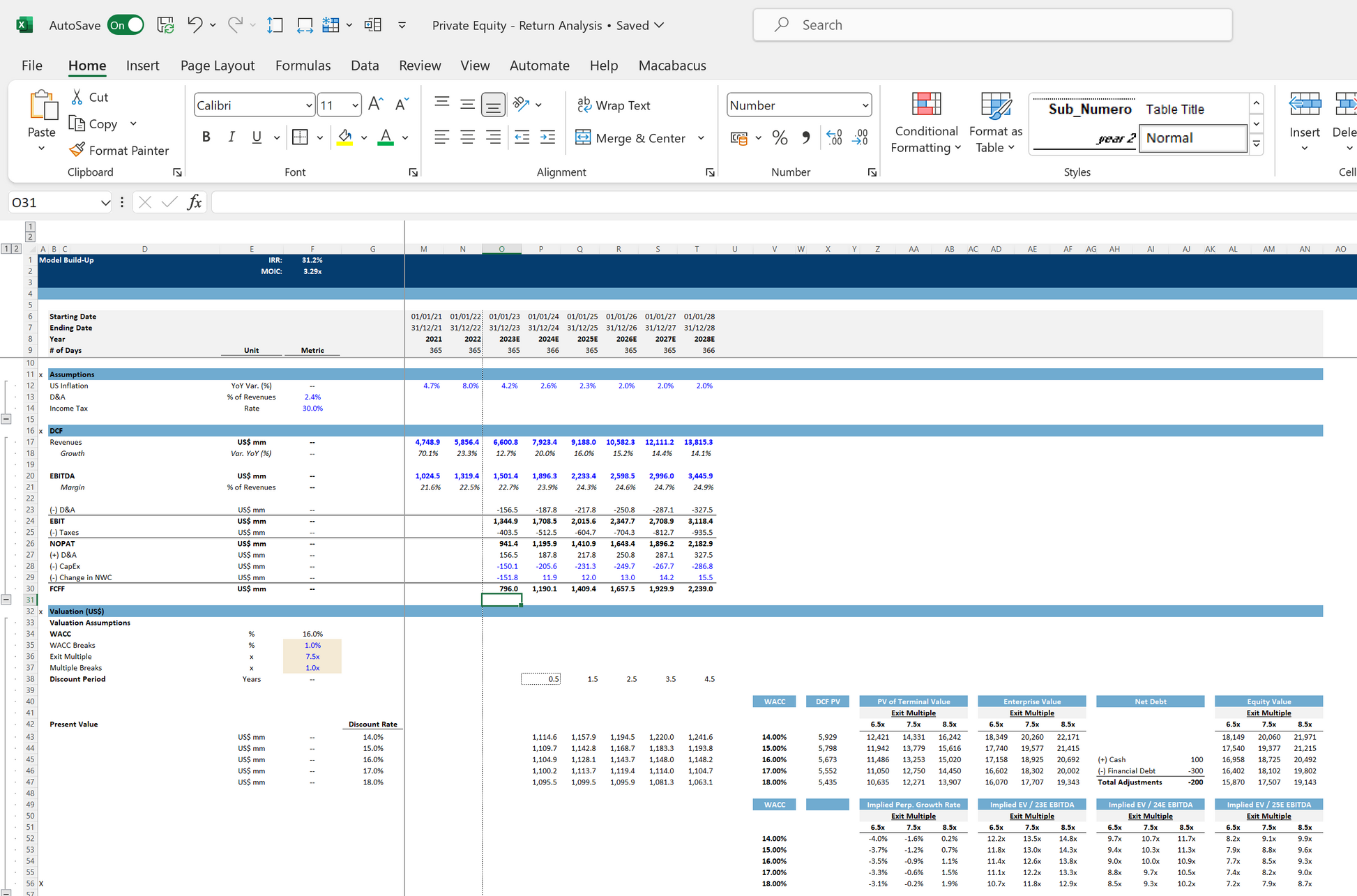

- Macro Assumptions: Start with a foundation of well-researched assumptions including market trends, revenue projections, and cost structures. These assumptions are essential for building realistic financial forecasts and setting the stage for detailed financial analysis.

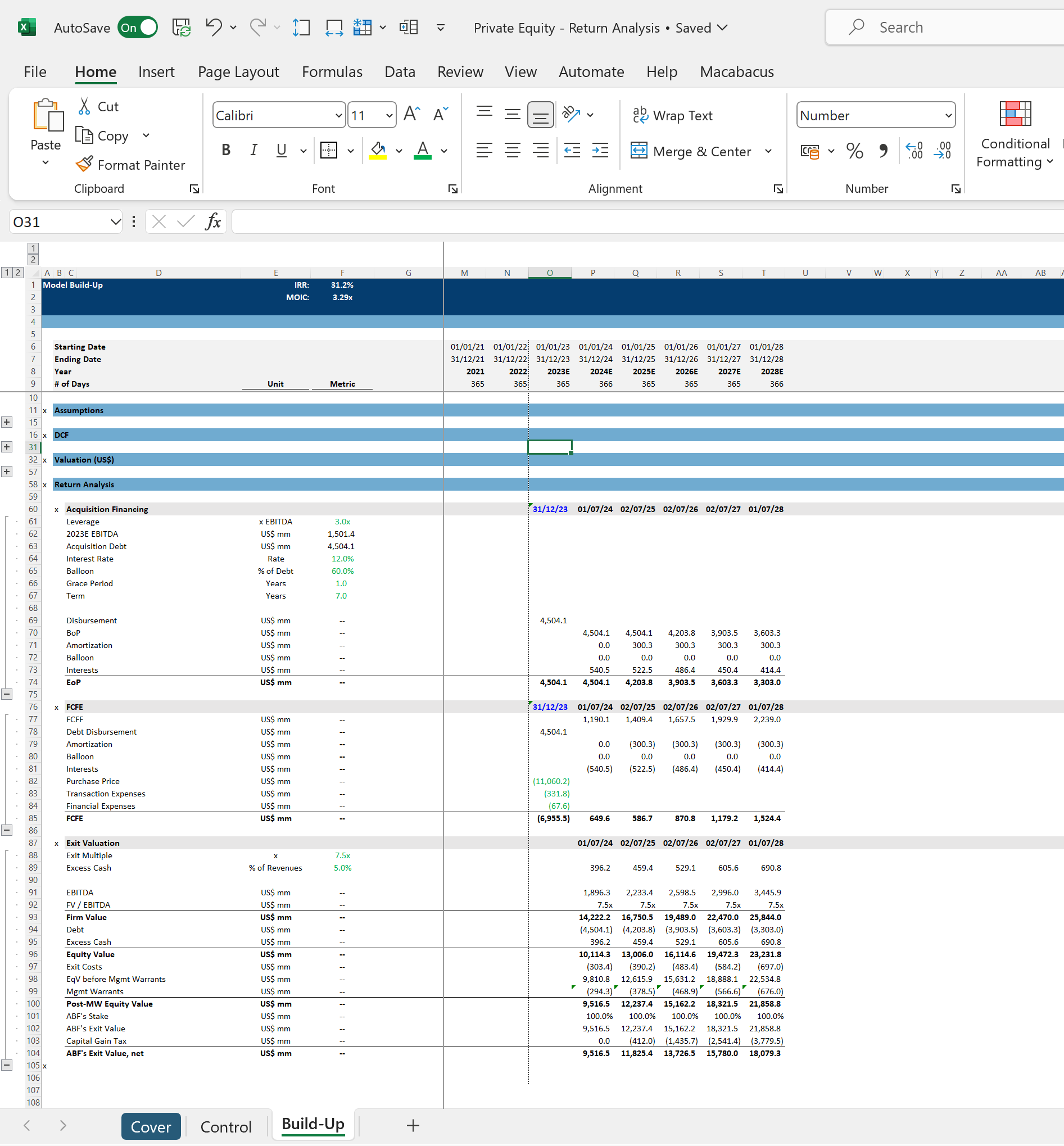

2. Cash Flow Build-Up:

- Historical Analysis: Begin with a thorough examination of the target company’s historical financial performance. This analysis provides insights into past cash flows and establishes a basis for future projections.

3. 5-Year Projections:

- Detailed Forecasts: Access a comprehensive set of five-year financial projections, including Income Statements, Balance Sheets, and Cash Flow Statements. These projections offer a detailed view of the company’s expected financial health and performance over the investment period.

4. Discounted Cash Flow (DCF) Valuation:

- Valuation Methodology: Utilize the DCF Valuation approach to estimate the present value of future cash flows. This method incorporates a discount rate specific to Private Equity investments to determine the intrinsic value of the target company.

5. Sensitivity Analysis:

- Risk Assessment: Explore how changes in key variables like revenue growth rates and discount rates affect the investment’s outcomes. This analysis helps you prepare for various scenarios and assess potential risks.

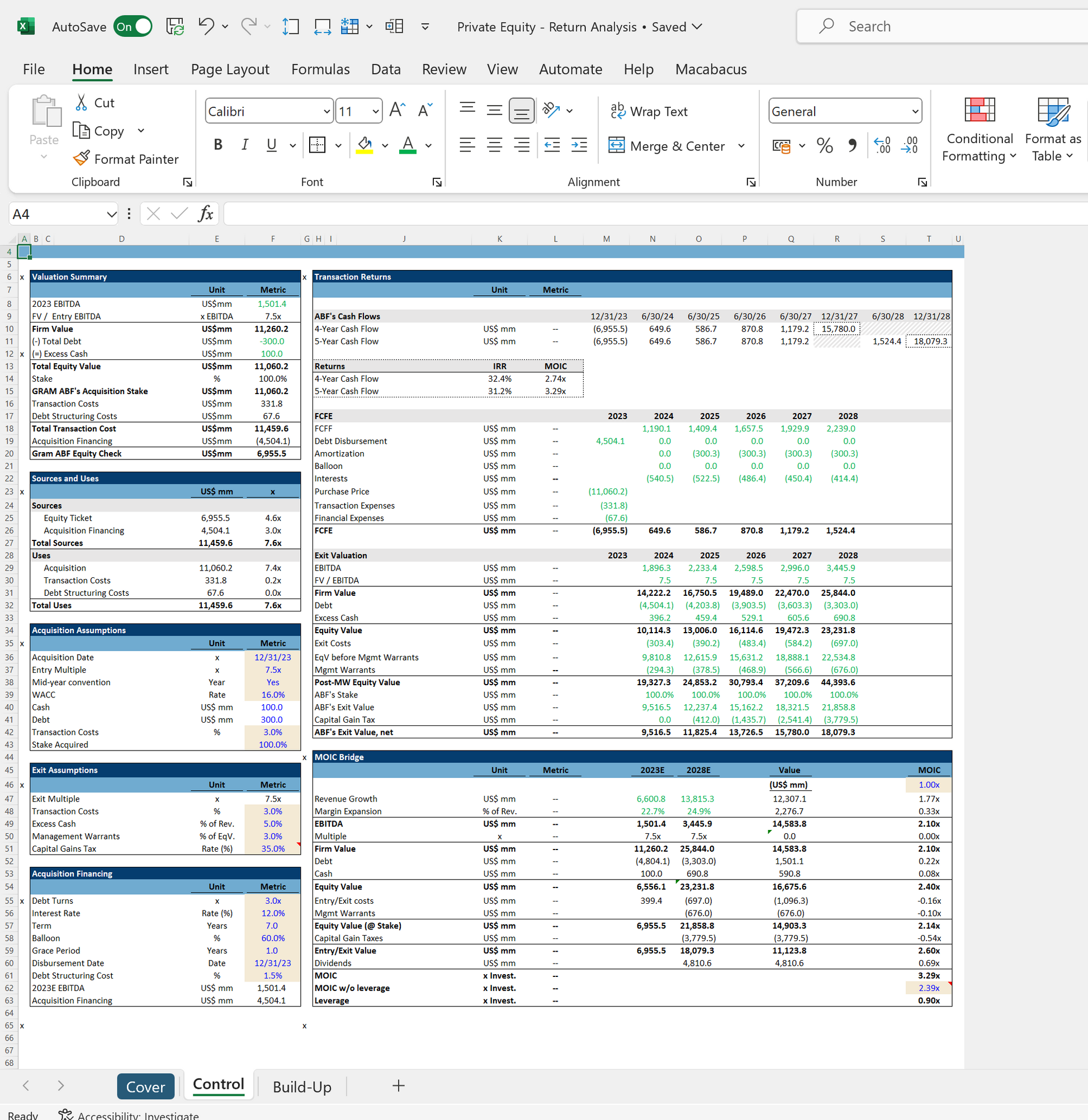

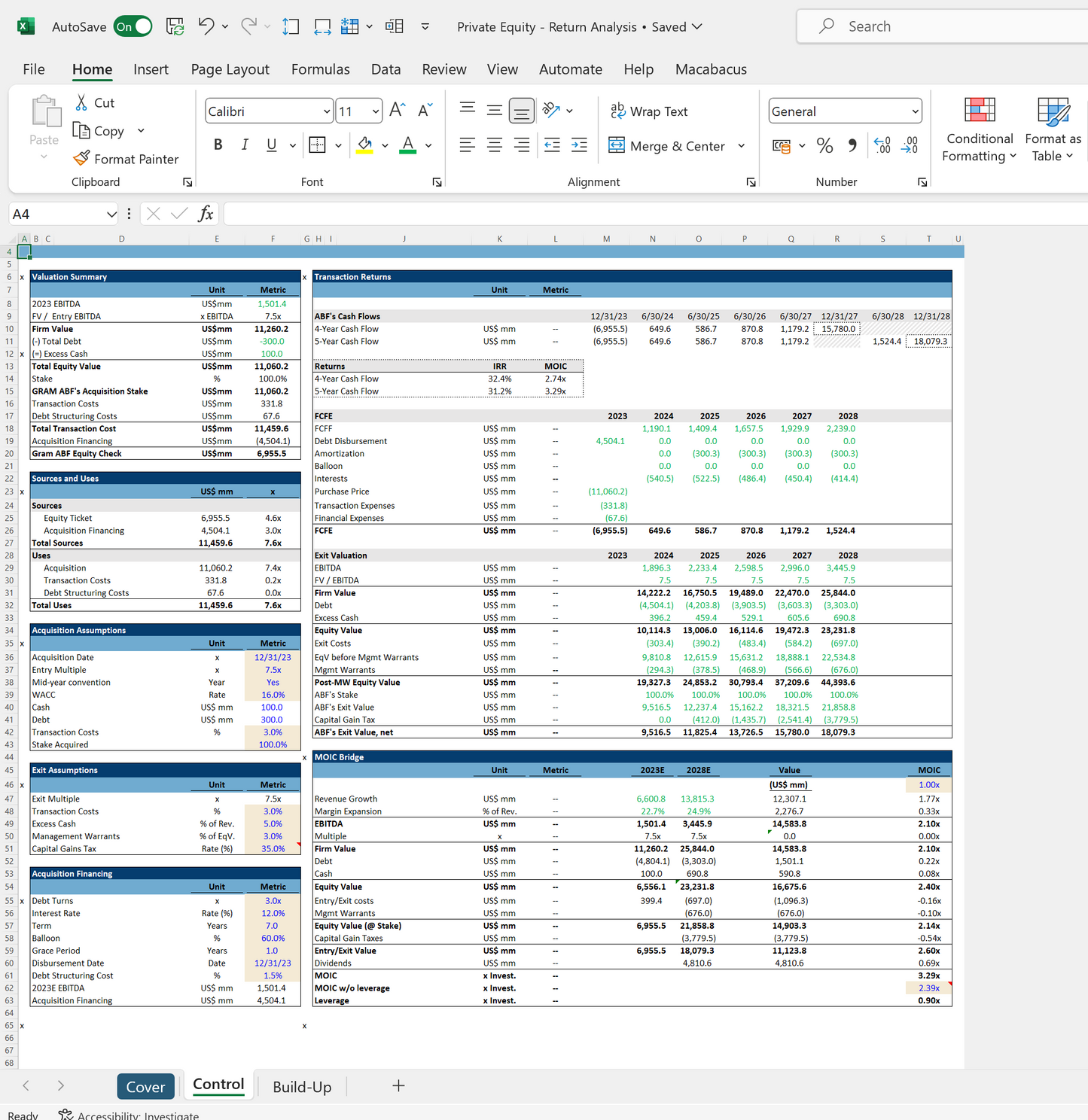

6. Return Analysis:

- Performance Metrics: Calculate key performance metrics including Internal Rate of Return (IRR) and Multiple on Invested Capital (MOIC). These metrics are crucial for evaluating the attractiveness of the investment and its alignment with your financial objectives.

7. MOIC Bridge:

- Value Drivers Visualization: Visualize how different value drivers impact the MOIC through the MOIC Bridge. Understand the effects of EBITDA expansion, debt repayment, and multiple expansion on your returns.

8. Sources and Uses of Funds:

- Financing Strategy: Gain insights into the investment’s financing strategy with a detailed breakdown of equity and debt financing. This section clarifies how the funds will be allocated to achieve strategic goals.

9. Exit Strategy:

- Strategic Planning: Develop and explore various exit strategies with projected timelines and potential returns. This section aids in planning your exit and assessing different scenarios for achieving investment success.

Benefits of Using Our Private Equity Financial Model

Informed Decision-Making:

- Make strategic investment decisions with detailed financial projections, valuation analyses, and risk assessments.

Comprehensive Analysis:

- Assess investment opportunities with thorough historical data analysis, financial projections, and DCF valuation methods.

Risk Management:

- Prepare for potential challenges with sensitivity analysis and explore different financial scenarios to manage risks effectively.

Investment Evaluation:

- Evaluate potential returns with IRR and MOIC calculations, and understand the impact of key value levers on investment performance.

Strategic Planning:

- Plan your investment and exit strategies with clear insights into sources and uses of funds, as well as potential exit scenarios.

User-Friendly Design:

- Navigate the model with ease using our intuitive interface, designed to cater to various levels of financial expertise.

Versatile for Various Industries:

- Adapt the model for different sectors, making it a flexible tool for evaluating investment opportunities across multiple industries.

Instant Download

Get Started Now:

- Immediate Access: Your Excel file will be available for download once payment is confirmed.

- Secure Download: The download link will be provided on the checkout page and sent to your email.

Note:

- This is a digital product. No physical item will be shipped.

- Digital items are non-returnable and non-refundable.

Site Policies: Thank you for choosing Apollo Financial Models. We are committed to delivering quality products and services. Please note that we operate under a No Refund, No Return Policy. For more details, visit our Site Policies page.

You will not need anything else other that those listed in the output. very detailed and easy assumptions and input. I like the way of the explanation in the front sheet. really deserve the value