Apollo Financial Models

Weighted Average Cost of Capital (WACC) Model

Weighted Average Cost of Capital (WACC) Model

Couldn't load pickup availability

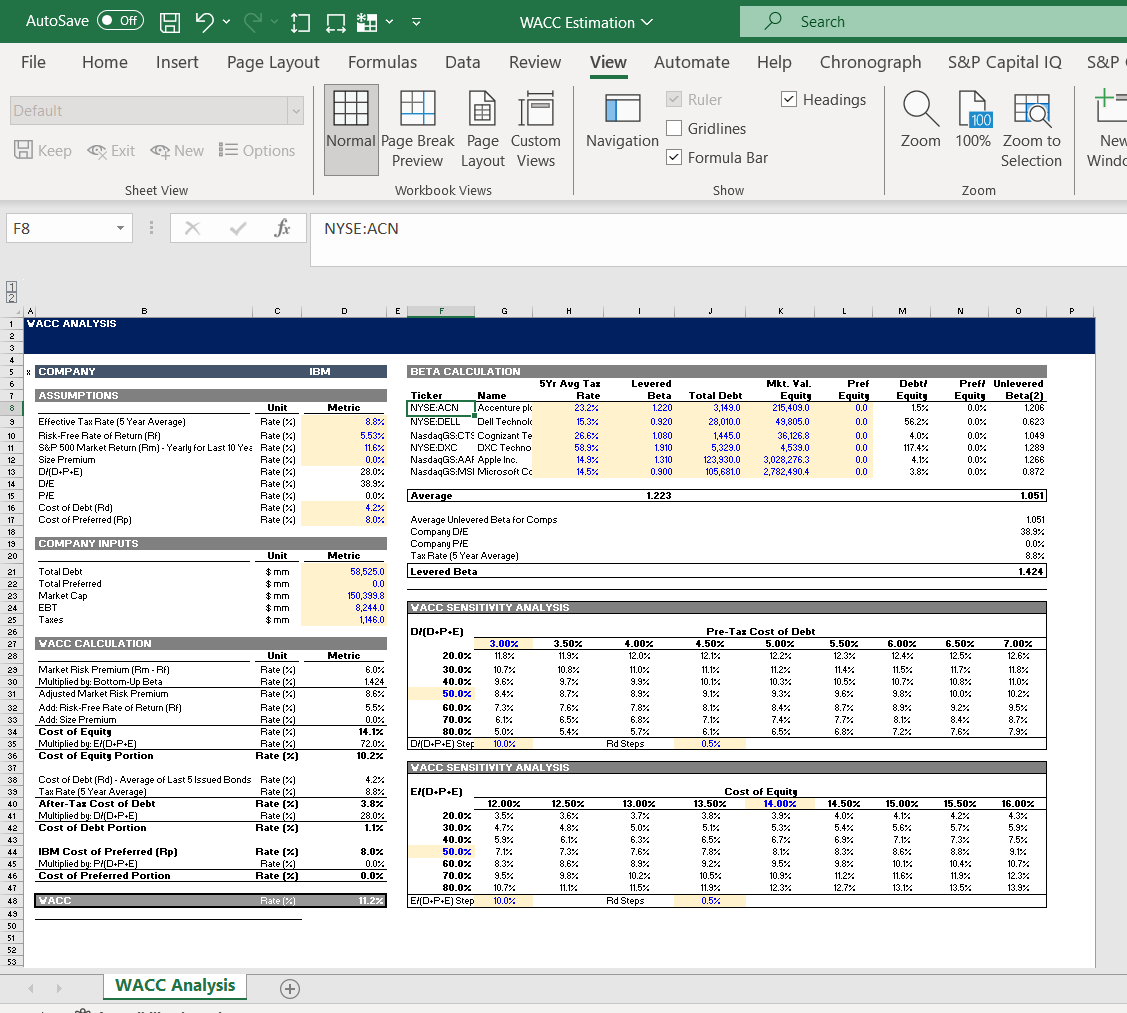

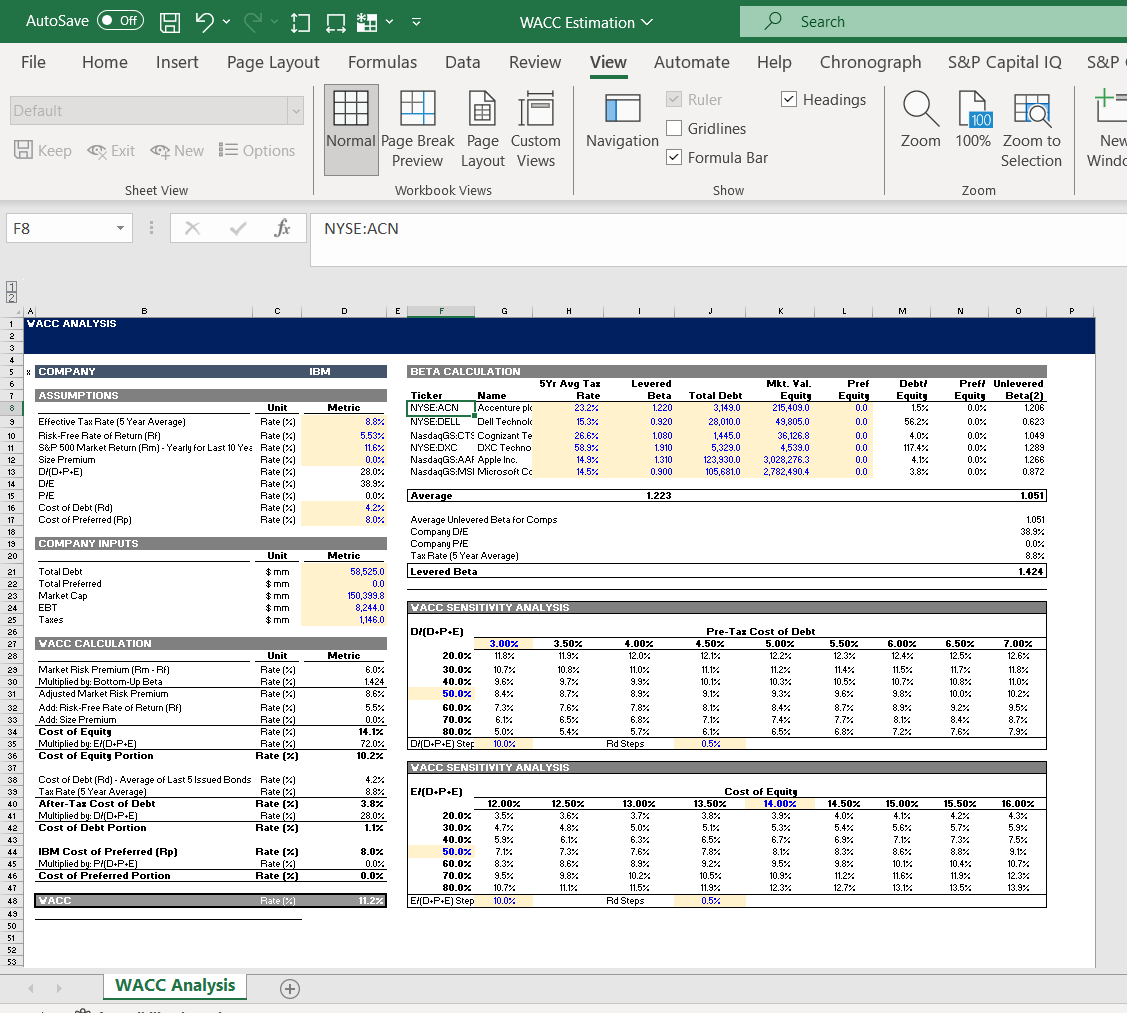

The WACC Calculator Excel Template is a powerful tool designed to help financial analysts, valuation professionals, and business decision-makers determine the Weighted Average Cost of Capital for a company. This comprehensive template incorporates advanced features for estimating the cost of equity, cost of debt, and cost of preferred equity. Additionally, it provides a robust methodology for beta estimation using comparable companies and includes two sensitivity tables for scenario analysis.

Key Features:

-

Cost of Equity Estimation:

- Utilize the Capital Asset Pricing Model (CAPM) or Dividend Discount Model (DDM) to calculate the cost of equity.

- Input key variables such as risk-free rate, market risk premium, and beta to derive the cost of equity.

-

Cost of Debt Estimation:

- Input parameters like interest rate, tax rate, and debt issuance costs to compute the cost of debt.

- Consider both current and new debt for a comprehensive analysis.

-

Cost of Preferred Equity:

- Customize inputs for preferred stock dividends and issuance costs to determine the cost of preferred equity.

- Incorporate any specific terms related to preferred stock.

-

Beta Estimation using Comparable Companies:

- Input comparable companies’ financial data and market information.

- Utilize regression analysis to estimate the beta, a crucial factor in the CAPM for cost of equity calculation.

- The template provides a detailed methodology for beta estimation, ensuring accuracy and reliability.

-

Two Sensitivity Tables:

- Perform scenario analysis with two sensitivity tables.

- Evaluate the impact of changes in key parameters (e.g., risk-free rate, market risk premium, beta) on the WACC.

- Enhance decision-making by understanding how variations in assumptions affect the overall cost of capital.

User-Friendly Interface: The template features a user-friendly interface with clearly labeled input sections, instructions, and tooltips to guide users through the data input process. Excel functions and formulas are transparent, allowing users to customize assumptions and easily interpret results.

Comprehensive Documentation: Accompanying the template is comprehensive documentation that explains the methodology behind each calculation, providing users with a clear understanding of the WACC estimation process and its components.

Applicability: This WACC Calculator is versatile and can be applied to a wide range of industries and business scenarios. Whether conducting business valuations, investment analysis, or capital budgeting, this template is an invaluable resource for financial professionals.

Conclusion: The WACC Calculator Excel Template is a sophisticated and versatile tool for estimating the Weighted Average Cost of Capital. Its user-friendly design, comprehensive features, and advanced analysis capabilities make it an essential asset for financial modeling and decision-making processes.

Instant Download:

Your Excel file will be available to download once payment is confirmed.

The download link will be ready on the page after the checkout procedure.

You will also receive the download link to your email.

Digital items don’t accept returns, exchanges, or cancellations.

This is a digital item. No product will be shipped physically.

Site Policies:

Thank you for choosing Apollo Financial Models. We take pride in providing quality products/services to our valued customers. As we strive for transparency, it's essential to mention that we operate under a No Refund, No Return Policy. Please visit our Site Policies page for a detailed explanation of all our usage policies.

Very easy to follow for non-finance background users. Saved me a lot of time and helped me minimize errors. :)